– Community Finance Ireland delivers €1.6million in support for Donegal community organisations.

Ballyshannon-based GAA Club, Aodh Ruadh is celebrating an upgrade to its facilities, helping it maintain county ground status and attract new members, thanks to funding from Community Finance Ireland (CFI).

Originally founded in 1909, Aodh Ruadh CLG is one of the foremost GAA Clubs in Co. Donegal, with around 400 members. The Club consists of the main pitch, Father Tierney Park, which holds county ground status and hosts at least one National Football League fixture each year. It also owns Pairc Aodh Ruadh (Mundy’s field) on an adjoining site, which consists of two sand-based playing fields and training facilities including a Fitness Trail and a Hurling Wall. Aodh Ruadh CLG has enjoyed significant success at County, Provincial & National level and offers both football & hurling to members.

Patsy Kilgannon, committee member at Aodh Rua GAA, said that awareness of Community Finance Ireland’s experience in supporting GAA clubs was a key factor in their decision-making process. He said:

“There was an awareness of Community Finance Ireland in the club, and we felt it was as convenient to go to Community Finance Ireland instead of traditional sources of finance. A great credit to Anne for making the process a positive experience all the way. The loan from Community Finance Ireland has been utilised to assist with our recent redevelopment costs, helping us to maintain county ground status and improve facilities for our members.”

Patsy Kilgannon, Committee Member, Aodh Ruadh GAA

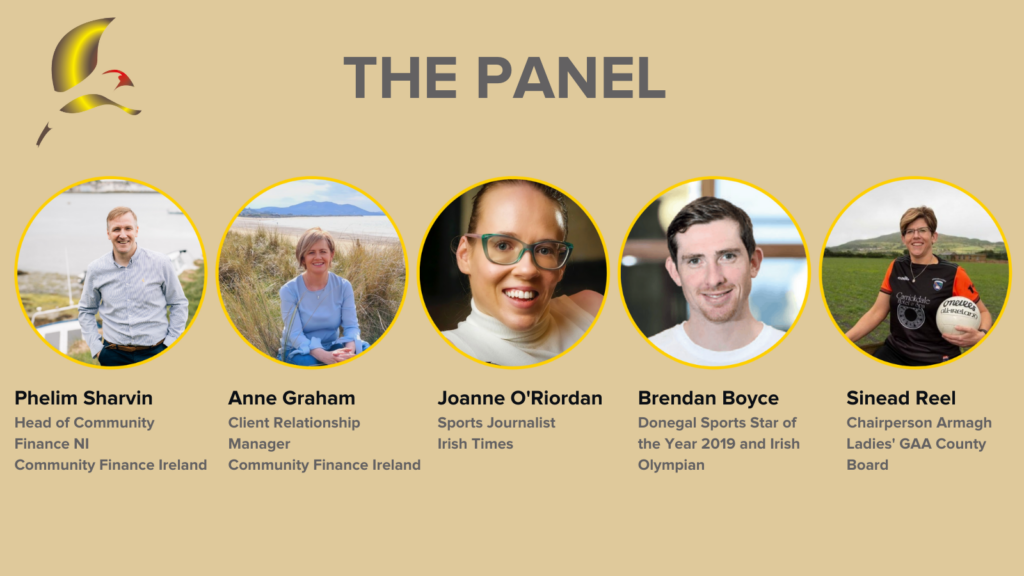

Since 2016, Community Finance Ireland has provided €1.6million in social finance loans to 21 projects based in Donegal. Client Relationship Manager for Connacht and Donegal, Anne Graham, says there’s huge potential for others in Donegal to follow in Aodh Ruadh’s footsteps.

Ms. Graham said:

“It’s fantastic to see GAA Clubs like Aodh Ruadh CLG investing in their facilities, which not alone helps them to maintain their county ground status, but no doubt plays a role in attracting and retaining members. Like Aodh Ruadh CLG, Community Finance Ireland is focused on social improvement – all the repayments made on social finance loans go right back into supporting another community group either here in Donegal or across the country.”

Anne Graham, Client Relationship Manager for Connacht and Donegal, Community Finance Ireland

About Community Finance Ireland

Community Finance Ireland delivers social finance solutions that support local communities and drive social impact through sports, community projects, faith-based groups, Arts & Heritage, Childcare, Environment, Health & Wellbeing, Housing, Tourism and social enterprises. It is the fastest growing dedicated social finance provider across the island of Ireland and the UK.

Community Finance Ireland is part of the UCIT Group, established in Belfast in 1995 and now supports a diverse portfolio of clients across the island of Ireland from Bantry to Ballymoney, and from Dublin to Dingle.

Currently, Community Finance Ireland is the only Irish and UK member of FEBEA, the European Federation of Ethical and Alternative Banks.

For further information, visit our website or follow us on Twitter.