The city of Derry~Londonderry has long been synoymous with Halloween. Known as the Halloween Capital of Europe and voted the best place in the world to celebrate it.

The festival returns in 2022 and will run from Friday 28th October right through until Halloween night. Featuring family orientated activities like monster making arts and crafts, a pumpkin hunt and Halloween storytelling. For older visitors there is cemetery tours, a dress up silent disco and music gigs from Alabama 3 and Hudson Taylor. There’s also a big fireworks finale.

If you are visiting Derry~Londonderry this Halloween, this is a also a perfect opportunity to visit some of the local social enterprises in the area. Delivered by volunteers and community champions, these local visitor experiences’ core purpose is social impact as well as visitors’ enjoyment.

Access to the Arts for All

Greater Shantallow Arts is a community arts organisation that aims to provide direct access to the arts within disadvantaged communities in the Greater Shantallow Area/Outer North Region of Derry. Their Studio 2 premises is one of Ireland’s best loved Arts centres. The group provide a range of activities from theatre shows to classes and workshops. The highlight of their year is their partnership with North West Carnival to create a wonderful Halloween Carnival.

Sensory Support

ASpace2 MultiSensory Centre provides day opportunities for adults and children with additional needs. The five multi-sensory rooms are designed to ensure that children and young adults with additional support needs are able to access a community facility which is age appropriate and is meaningful regardless of ability.

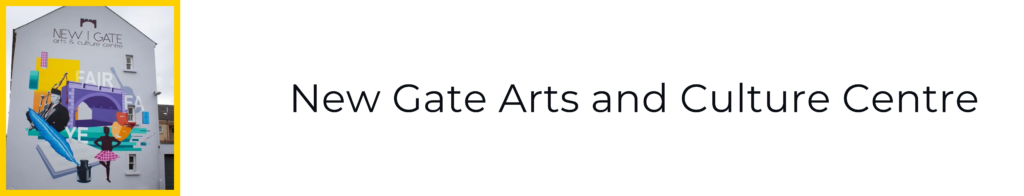

Book your Choice – there’s loads to choose from:

New Gate Arts & Culture Centre is a vibrant arts and culture centre located in the Fountain area of the city. Close to the historic walls and the city centre it offers a range of workshops, classes, performances, talks, tours, festivals and cultural events with something for everyone.

Inclusive Coffee taste:

The Whistle Stop Café is found on Derry’s Foyle Road and is part of the North West Learning Disability Centre. It is the perfect stop for a bite to eat or a delicious baked treat after a visit to the nearby St Columb’s Cathedral. The café is a fantastic social enterprise that offers employment opportunities to people with disabilities.

History Buffs this way:

The Museum of Free Derry is dedicated to telling the story of what happened in the city between the years 1968 and 1972. Located in Derry’s Bogside where the events of Bloody Sunday unfolded, particular focus is paid to those most involved and effected by these events. The exhibition aims to remember and help understand the local history of the city and its contribution to the ground breaking civil rights struggle which erupted in Derry in the mid-1960s and culminated in the massacre on Bloody Sunday. A must see for any history aficionados.

Visit the Farm and make new friends

Just a 20 minute drive outside of the city, Gortilea Social Farm provides a space for practical, meaningful and enjoyable day experiences in a rural environment irrespective of ability or disability. Visitors can look after a range of livestock from sheep, cattle and horses as well as learning about growing and cooking healthy meals. Providing both indoor and outdoor activities ensures that there is something to do no matter the weather conditions.

Spending your time and money in these venues not only helps deliver social impact but is an endorsement that, the local volunteers and committees’ efforts are valued.

#Social Time is always a good time.